Because of generous, forward-thinking friends like you, people experiencing homelessness will have a strong and vocal advocate well into the future. Your personal legacy will help change lives! The New Community Shelter simply could not exist but for investments like the ones you make.

DONATION PLANS BY DOLLAR AMOUNT

Under

$25,000

- Outright Gift of Cash

- Outright Gift of Appreciated Securities

- Donor Advised Fund

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Beneficiary Designations

$25,000 to

$99,999

- Outright Gift of Cash

- Outright Gift of Appreciated Securities

- Donor Advised Fund

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Beneficiary Designations

$100,000 to

$999,999

- Outright Gift of Appreciated Securities

- Gift in Your Will or Living Trust

- Beneficiary Designations

- Charitable Gift Annuity

- Outright Gift of Life Insurance

- Charitable Remainder Trust

- Charitable Lead Trust

$1 Million

or more

- Outright Gift of Appreciated Securities

- Gift in Your Will or Living Trust

- Beneficiary Designations

- Charitable Remainder Trust

- Charitable Lead Trust

DONATION PLANS BY AGE

Under 40

- Outright Gift of Cash

- Outright Gift of Appreciated Securities

- Donor Advised Fund

- Gift in Your Will or Living Trust

- Beneficiary Designations

40-54

- Outright Gift of Cash

- Outright Gift of Appreciated Securities

- Donor Advised Fund

- Gift in Your Will or Living Trust

- Beneficiary Designations

55-69

- Outright Gift of Appreciated Securities

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Beneficiary Designations

- Charitable Remainder Trust

- Charitable Lead Trust

70+

- Outright Gift of Appreciated Securities

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Beneficiary Designations

- Make a Gift Tax-Free with an IRA

- Outright Gift of Life Insurance

- Charitable Remainder Trust

- Charitable Lead Trust

DONATION PLANS BY ASSET TYPE

Cash

- Outright Gift of Cash by check, credit card or direct deposit

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Donor Advised Fund

- Charitable Remainder Trust

- Charitable Lead Trust

Appreciated Securities

- Outright Gift of Appreciated Securities such as stocks and IRA's

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Donor Advised Fund

- Charitable Remainder Trust

- Charitable Lead Trust

Retirement Plan Assets

- Beneficiary Designations

- Make a Gift Tax-Free with an IRA

- Charitable Remainder Trust

- Donor Advised Fund

Life Insurance

- Outright Gift of Life Insurance (NCS can get the cash value right away)

- Beneficiary Designations given at end of life

Tangible Personal Property

- Outright Gift or Bargain Sale

- Gift in Your Will or Living Trust

- Charitable Gift Annuity

- Charitable Remainder Trust

DETAILS & EXAMPLES

Gift Your Will or Living Trust

You want to leave money to the New Community Shelter in your will. You also want the flexibility to change your will in the event that life circumstances change. You can do both. In as little as one sentence, you can complete your gift. This type of donation to the shelter in your will or living trust helps ensure that we continue our mission for years to come.

EXAMPLE OF HOW IT WORKS

Meet Tom and Martha. When they got married and created a will, they included a $75,000 gift to the New Community Shelter. As the family grew to include three children, Tom and Martha decided to revise their gift to ensure their children's future financial security. They met with their attorney and revised the gift language so that NCS received a percentage of their estate, instead of a specific amount. Tom and Martha now rest easy knowing their plans will provide for the people and charitable work they love.

Beneficiary Designations

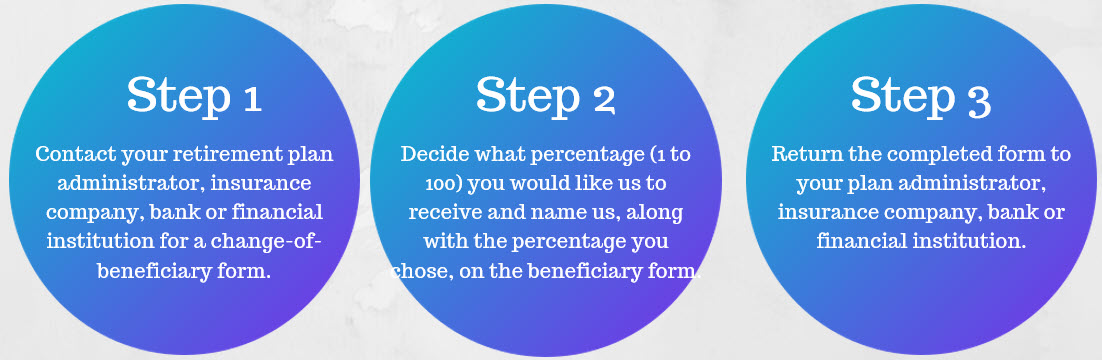

Make a gift in 3 easy steps

Not everyone wants to commit to making a gift in their wills or estates. Some prefer the increased flexibility that a beneficiary designation provides by using: IRAs and retirement plans, life insurance policies, and commercial annuities. It only takes three simple steps to make this type of gift. Here's how to name the New Community Shelter as a beneficiary:

Charitable Gift Annuity

There's a way for you to support the New Community Shelter and feel confident that you have dependable income in your retirement years. You can do this with a charitable gift annuity. This type of donation can provide you with regular payments and allow us to further our work. You can also qualify for a variety of tax benefits, including a federal income tax charitable deduction when you itemize. Your payments depend on your age at the time of the donation. If you are younger than 60, we recommend that you learn more about your options of a Deferred Gift Annuity.

EXAMPLE OF HOW IT WORKS

Dennis, 66, and Mary, 65, want to make a contribution to the New Community Shelter but they also want to ensure that they have dependable income during their retirement years. They establish a $20,000 charitable gift annuity. Based on their ages, they will receive a payment rate of 4.5 percent, which means that they will receive $900 each year for the remainder of their lives. They're also eligible for a federal income tax charitable deduction of $6,129 when they itemize. Finally, they know that after their lifetimes, the remaining amount will be used to support our mission.

Charitable Remainder Trust

If you have built a sizable estate and also are looking for ways to receive reliable payments, consider a charitable remainder trust. These types of gifts may offer you tax benefits and the option for income. There are two ways to receive payments and each has its own benefits:

•The annuity trust pays you, each year, the same dollar amount you choose at the start. Your payments stay the same, regardless of fluctuations in trust investments.

• The unitrust pays you, each year, a variable amount based on a fixed percentage of the fair market value of the trust assets. The amount of your payments is redetermined annually. If the value of the trust increases, so do your payments. If the value decreases, however, so will your payments.

EXAMPLE OF HOW IT WORKS

Susan, 75, wants to make a gift to the New Community Shelter but would also like more income in the future. Susan creates a charitable remainder trust with annual lifetime payments to her equal to 6% of the fair market value of the trust assets as revalued annually. She funds the trust with assets valued at $500,000. Susan receives $30,000 the first year from the trust. Subsequent payment amounts vary each year depending on the annual valuations of the trust assets. She is eligible for a federal income tax charitable deduction of $276,880 in the year she creates and funds the trust. This deduction saves Susan $88,232 in her 32 percent tax bracket.

Make a Gift Tax-Free with an IRA

If you are 70½ years old or older you are required to take money out of your retirement account (4%) and pay taxes in it. You may take a Qualified Charitable Distribution and donate it to the New Community Shelter and receive tax benefits in return. You can give up to $100,000 from your IRA directly to a qualified charity such as ours without having to pay income taxes on the money.

WHY CONSIDER THIS GIFT?

Your gift will be put to use today, allowing you to see the difference your donation is making. You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions. If you have not yet taken your required minimum distribution for the year, your IRA charitable rollover gift can satisfy all or part of that requirement.

A Donor Advised Fund

A donor advised fund, which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to the New Community Shelter. You transfer cash or other assets (such as Stock) to a tax-exempt sponsoring organization such as the New Community Shelter. In return, you qualify for a federal income tax charitable deduction at the time you contribute to the account.

EXAMPLE OF HOW IT WORKS

Joe and Laura want to give back to their hometown by putting their money where it will do the most good. They establish a $25,000 donor advised fund with a community foundation. The couple receives a federal income tax charitable deduction for the amount of the gift. Joe and Laura recommend a grant for the New Community Shelter. The foundation presents NCS with a check from the Megan Fund, which Joe and Laura named in honor of their daughter. Joe and Laura are delighted to start this personal legacy of giving.

Charitable Lead Trust

You can benefit from the tax savings that result from supporting the New Community Shelter without giving up the assets that you'd like your family to receive someday with a donation in the form of a charitable lead trust. There are two ways that charitable lead trusts make payments to NCS:

- A charitable lead annuity trust pays a fixed amount each year to the NCS and is more attractive when interest rates are low.

- A charitable lead unitrust pays a variable amount each year based on the value of the assets in the trust. With a charitable lead trust, if the trust's assets go up in value, for example, the payments to the NCS go up as well.

EXAMPLE OF HOW IT WORKS

George would like to support the New Community Shelter and provide for his children. George received a windfall amount of income and needs a large income tax deduction to offset the income. Following his advisor's recommendation, George funds a grantor charitable lead annuity trust with assets valued at $1,000,000. George's trust pays $70,000 (7% of the initial fair market value) to NCS each year for 15 years, which will total $1,050,000. After that, the balance in the trust reverts back to George. He receives an income tax charitable deduction of $854,311. Assuming the trust earns an average 6% annual rate of return, George receives approximately $767,240 at the end of the trust term.